#BEST BUDGETTING APPS FOR MAC TV#

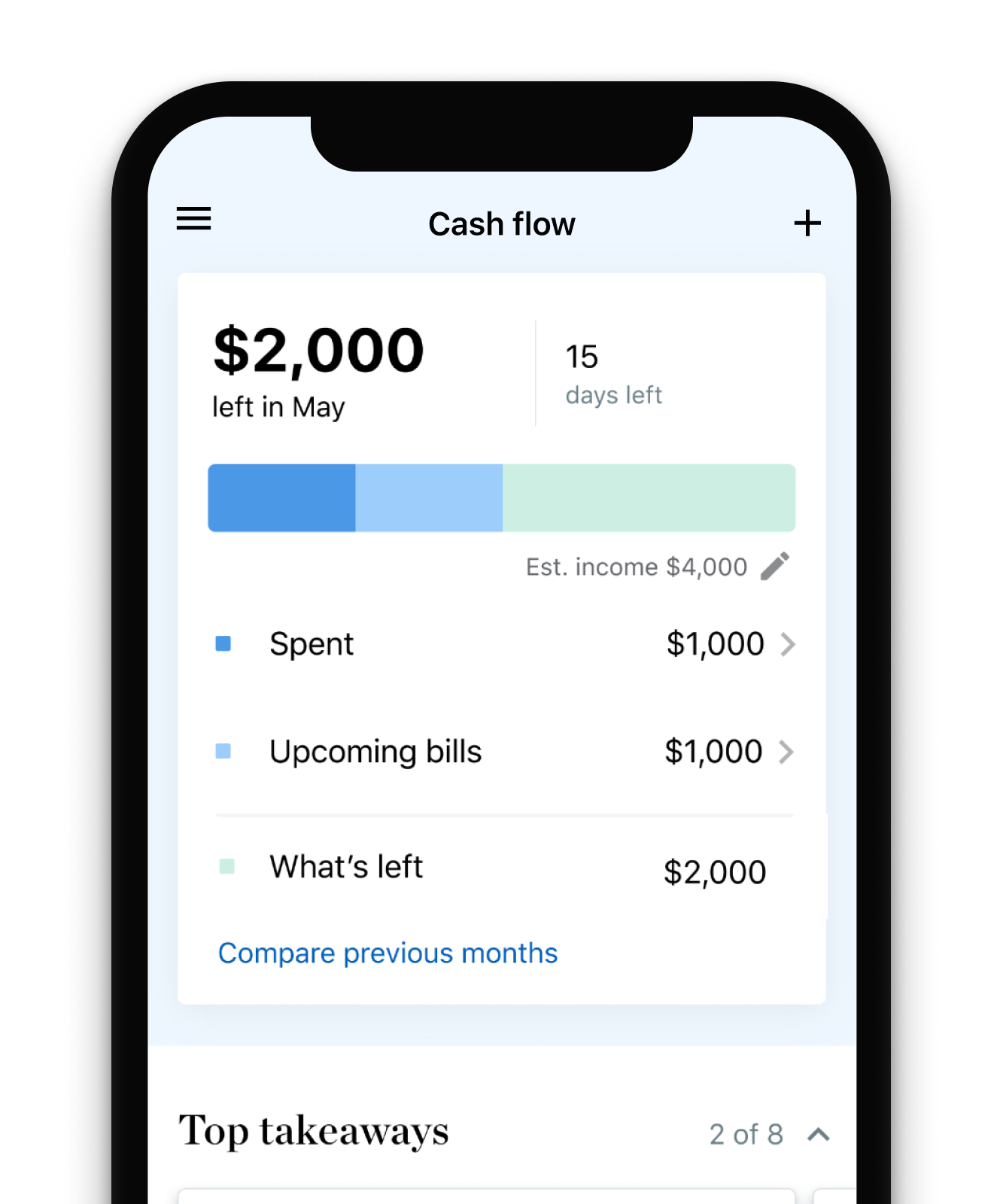

Utilities - energy, water, broadband, phone bill and TV licence.These are things you cannot do without - your absolute necessities, such as: The three main budget categories are needs, wants and savings. Additionally, many banks now offer a spending tracking and categorisation feature on current accounts free of charge.

#BEST BUDGETTING APPS FOR MAC DOWNLOAD#

Most of these budgeting apps are entirely free to download and use. There are situations where you need to be a bit flexible with the rule, and it makes perfect sense to adjust the ratios to suit your needs.įor instance, if you are struggling with debt and can barely afford to meet your monthly repayment obligations, allocating 30% of your income to wants and 20% to savings and extra debt might not work for you.Ĭonsider your own financial situation before deciding on what budget rule to use.Ī budgeting app that tracks, categorises, and analyses your spending could help you better understand how much to allocate to wants, needs and savings. The 50-30-20 budget rule helps you categorise your spending and make long term plans for savings and investing, but it does not work in every circumstance. Input your net monthly income (after tax and national insurance contributions).

0 kommentar(er)

0 kommentar(er)